“Synchronicity” is a concept that was coined by the Swiss psychiatrist Carl Jung to describe events that even though are meaningfully related, do not have any apparent causal relationship among them (i.e. no one event causes another). They are just “meaningful coincidences”, as he put it!

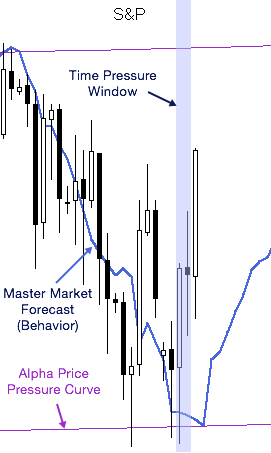

Keeping that in mind, let’s look at this morning’s S&P chart as of the time this post was prepared. For the benefit of our newer readers, we have added a couple of notes to the chart to explain what we are referring to in our discussion.

The chart above has three of our proprietary tools plotted on it; namely the alpha price pressure curve, the June 16/17 time pressure window, and the master market forecast.

Price pressure curves provide special support and resistance levels to the market’s price action. Price action may poke through them on an intraday basis but never manages to close above them in an uptrend or below them in a downtrend until time expires!

Time pressure points or windows similarly provide support and resistance levels for market action but in terms of time. Finally, the master market forecast delineates the overall predicted behavior for the market days and weeks in advance.

The famous trader and technical analyst W. D. Gann had once said “When price meets time, change becomes imminent” and, as discussed in our June 16th post (read it here), June 16/17 was a time pressure window that was meeting our alpha price pressure curve. When that happens, according to Gann, change becomes imminent and that is exactly what we saw happen to the markets… change!

The master market forecast had predicted that rebound weeks in advance. Remember that the forecast delineates the overall market behavior within a few days either way depending on the phase that the markets are in. Other tools such as time pressure points/windows help pinpoint the market turns and tell us whether markets are accelerating, decelerating, or right on.

Now, the first question is: could the market’s reaction to our forecast (in terms of time, price, and behavior) be a mere synchronicity as defined by Jung or could there be something more to it?! Food for thought!

The second question is: could this be just a temporary counter-trend move in an overall bearish trend that might be forming, or a reversal back to the upside to resume the bullish trend?! Of course, those who own our master market forecast know the answer to this question and are positioned to take advantage of what is about to unfold next!

You can see how the combination of just three of our proprietary tools can be very powerful in figuring out what the markets are up to during these insane times!

We use these tools as well as others to help our premium subscribers safely navigate and profit from the markets.

If you are interested in becoming a premium subscriber or obtaining a copy of our one month or one quarter master market forecast, please contact us by clicking here.

Click here to join our free mailing list for a taste of our unique market insight/foresight. To join our premium newsletter and receive our premium content, send us an email from the “contact us” page here and we will send you the subscription link with all the details.